- The dynamically changing economic ecosystem, pandemic and rising interest in opening additional sales channels prompted Unity Group to explore commerce transformation processes in the B2B segment.

- Together with CubeResearch agency Unity Group conducted an extensive study*. Its main objective was to measure the commerce transformation level and potential of Polish B2B companies.

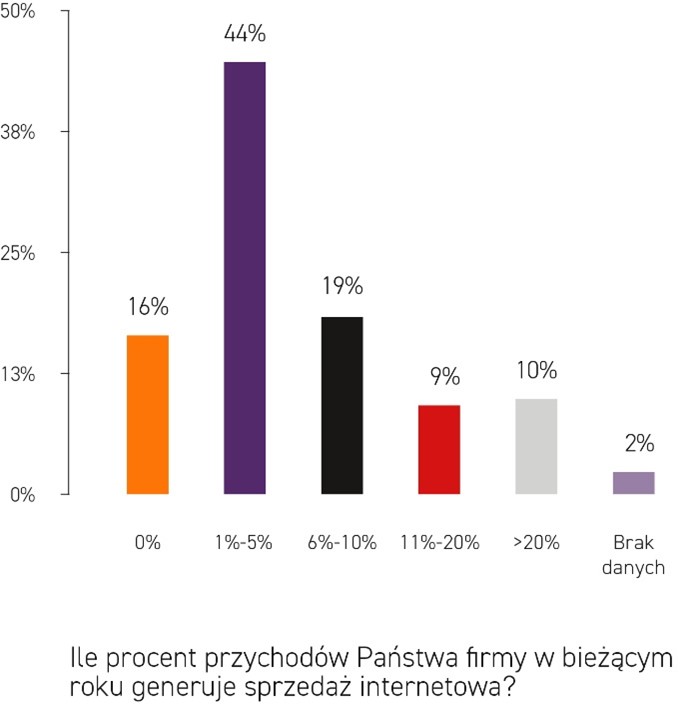

- The report shows that 57 percent of respondents see the impact of the pandemic on the digitization of sales. More than 80 percent of surveyed companies sell online, but for 79 percent of this group, online channels represent less than one-tenth of turnover – how do we improve these ratings and realize the potential?

Digital transformation: the market is currently dominated by two extreme trends when it comes to how businesses operate in the area of digitization. Companies already at an advanced stage of the transformation process know what they want to achieve and how to do that. They are also aware what should be changed further. However, they often do not have enough resources – primarily time and people – to continue making these changes. On the other hand, we can also distinguish a group of companies that have time and employees, but do not feel the need to change or lack ideas on what kind of upgrades could be introduced.

Despite the trends, the pace at which digital transformation of business, especially commerce, has progressed over the past few years has been rapid. The numbers gauging sales in the B2B channel were brought to light in the report „Polish B2B Market vs. the Digital Megatrend“ (PL) by Unity Group. Experts from PFR, LPP SA, eRecruiter, Selena FM S.A and others were invited to comment on the data.

Our goal for the report was clear – we wanted to check the level and potential of digital transformation of commerce in companies operating in the B2B model on the Polish market. Today e-commerce has the potential for dynamic growth, but only those who catch up with the rest of the market in terms of digital transformation stand a chance of getting a piece of that pie.

– says Grzegorz Rudno-Rudziński, Managing Partner, Unity Group.

Interestingly, our observations show that B2B is slowly beginning to adapt the trends developed by B2C, and the driving force behind the whole process is the rapidly changing needs of B2B customers. As a company devoted to launching digital B2B channels, we’ve been observing this trend for more than 10 years, but since the last year it has accelerated sharply, because with the outbreak of the pandemic, the online channel has been the only sales opportunity for many companies

What’s more, a type of „B2B consumerization“ is taking place, which means that customers accustomed to B2C standards will expect the same shopping experience also in the business area, and companies in this sector have to pick up the gauntlet, because the pandemic has made the fight for customers online even more fierce now

– adds Grzegorz Rudno-Rudziński.

The change in consumer behavior is not a temporary situation, but rather a permanent shift in purchase preferences. Therefore, today’s market is much more interested in investing in innovative solutions that can help to stay ahead of the competition and differentiate from it. Similarly, among vital development projects, process automation is gaining importance, which allows you to protect yourself from unforeseen situations, such as those that occurred last year. What does it mean? According to Grzegorz Rudno-Rudzinski, in 2021 the question is no longer whether it is worth investing in the implementation of digital commerce transformation, but how to do it quickly and at optimal cost, because every day of delay aggravates the difficult situation of many companies and distances the chance of taking advantage of the changes taking place.

Dormant Potential

According to the survey, more than 80 percent of the companies surveyed sell online, but for 79 percent of this group online sales represent less than one-tenth of turnover. Only 16 percent of B2B businesses do not use the online channel. Among commerce companies, however, digital sales channels are particularly important – there, the percentage of those who do not sell online shrinks to just 4.

One in ten companies can speak of an online turnover of more than 20 percent, with over 14 percent of commerce and services companies already enjoying such a turnover structure. This means that for commerce and services, the digitalization of B2B sales (understood as a technological change) has crossed the threshold of market adoption.

An e-commerce development strategy requires long-term and multi-faceted thinking. You should avoid focusing solely on the sales applications, which are of course important, but also directly connected to many other systems of the company. We try to anticipate and act, preparing our platforms so that they can easily scale and be ready for different scenarios. The effects of this came to fruition during the lockdown, which of course no one saw coming, but the systems were ready to adapt quickly for a change in our sales strategy. This and our work methodology (agile) allowed us to take advantage of the opportunities brought by the crisis

– says Arkadiusz Wróbel, IT Director, LPP S.A.

Pandemics Are Erratic

More than half of the surveyed entities note the impact of the pandemic on the digitalization of sales, while for companies with an annual turnover of more than 50 million PLN this percentage rises to more than 60 percent, and among companies with a turnover of up to 50 million PLN it is lower – close to 40 percent.

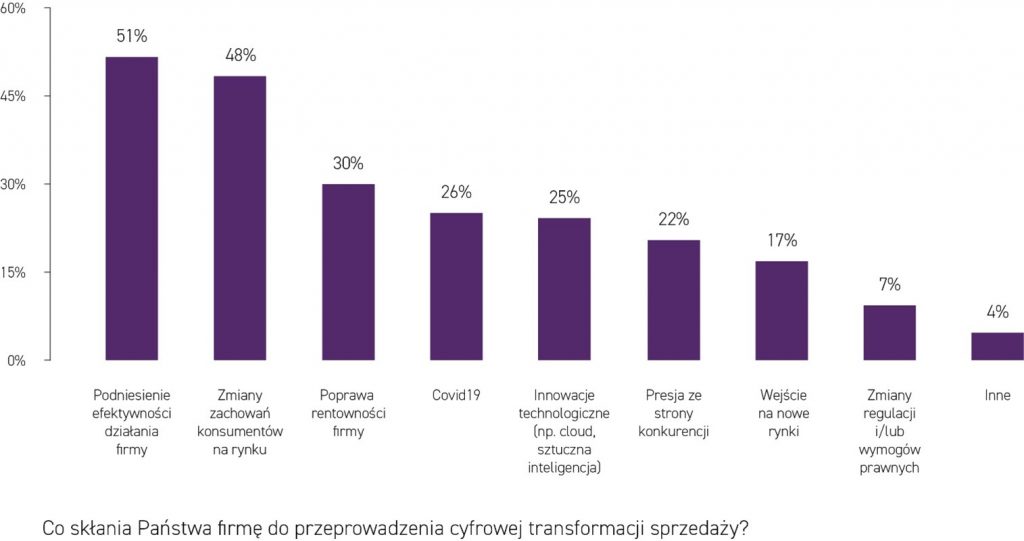

From the left: efficiency improvement, change in consumer behavior, improved profitability, COVID-19, tech innovations, competitive pressure, expansion into new markets, changes in regulations, other.

Respondents as the main reason for introducing new solutions in this area cited increased efficiency of company operations (51 percent) and changes in consumer behavior in the market (48 percent). The pandemic was indicated by 26 percent of respondents.

Transformation in the Absence of a Plan and Motivation

The results of the survey show a clear divide in the perceptions of the B2B readiness to change between owners, boards and managers. The lower down in the structure, the greater the skepticism towards change. This is because owners evaluate their visions and ideas over a time horizon of 12 to 24 months. Managers and many boards, on the other hand, operate on a bonus system, so their plans involve a perspective of less than a year. For them, transformation is often just extra work for which they will not be rewarded in the time horizon in which they operate

– says Grzegorz Rudno-Rudziński.

More than half of the companies surveyed (54 percent) do not have a digital transformation strategy. At the same time, those companies that do have such a strategy or are in the process of developing one (the remaining 46 percent of respondents) – provided that they implement it successfully – can expect a jump in their level of digitization. Notably, among them, only about 19 percent of the companies declared that they have a digital strategy and 18 percent that they are leading digital transformation.

Online Sales vs. Existing IT Systems Architecture

The foundation of IT systems lies in CRM (customer relationship management system) and ERP (enterprise resource management system) that businesses have been adapting since the 1990s. 75% of companies have them or plan to implement them within a year. Meanwhile, WMS (warehouse management) and CMS (content management systems) solutions will soon reach a 70% penetration rate. These are base systems for commerce automation. The second wave of digitalization and digital transformation is marked by e-commerce, Business Intelligence (business analytics, BI) and POS solutions, which are used by about 42 percent of companies. Unity Group experts estimate that this level should increase to nearly 60% within a year.

The surprise of the survey is that despite the difficult pandemic conditions, as many as 37 percent of respondents have no plans to invest in e-commerce and BI. This means that these companies will not be able to evaluate what and how they sell, much less be able to sell online themselves

– says Grzegorz Rudno-Rudziński.

Which solutions are most often omitted by companies? Integration solutions are highly underestimated – as many as 60% of companies do not plan to implement them. This differentiates the analyzed B2B industry from the mature B2C industry. At the other extreme are PIM-type tools (product information management systems), which are the fastest growing out of the entire omnichannel architecture. Admittedly, only 20% of companies currently have them, but the next 30% are planning to implement them. This is the right direction, as good quality and consistent product descriptions are crucial in online marketing.

The survey also clearly showed that companies with significant online revenue are investing not only in the e-commerce front-end itself, but in the entire solution architecture that builds the foundation for omnichannel.

Get to know the Polish B2B landscape – download the report here! (PL)

* – The findings presented have been created based on the results of a survey conducted in October 2020 on a sample of 502 decision makers from B2B companies. It was conducted using a combined CATI (telephone interviews) and CAWI (online interviews) method. The survey used data weighting so that the structure of responses better reflected the actual situation of companies.