Parcel Locker Wars / Will Consumer Love Support Multiple Brands?

Sooner or later, competition always comes a knocking. Today’s consumer has numerous ways to get their products. They can pick it up themselves, have it delivered or… as is becoming more and more commonplace, have it sent to a parcel locker to be picked up later.

This option – which offers some of the benefits of the other means – is a huge success here in Poland, thanks to our domestic InPost company. However, just as InPost is spreading throughout Europe, competitors from those companies are moving inwards. Most recently, DHL and Cainiao have paired-up and invested 60 million EUR into a competing parcel locker system, following entries into the likes of British and German markets.

No matter where you operate, the market is about to become a lot more diverse. For companies and consumers alike, this can mean some big changes and opportunities. But first, we need to segue into another topic…

A Parallel in VOD

For a long time, Netflix was the dominant (and in the early days, only) player in the Video-on-Demand market. They migrated to streaming when their competitors, such as Blockbuster, relied on analogue means alone. But history shows us that everyone is the top of their industry… until they’re not.

Today companies like HBO and Disney all offer their own competing streaming services. What’s more, the battle isn’t fought on lowball pricing, but rather on the quality of the offer. Customers with more disposable income are able to subscribe to multiple offers, while others choose to spend their money more wisely.

Why Do People Love Parcel Lockers?

Again, the parallel to video on demand should be somewhat clear. VODs put the control into the consumer’s hands. They can watch what they want to watch, when they want to watch it.

Parcel lockers are not so different. They provide an alternative that disrupted the traditional delivery means. Their huge success shows that they’ve found their market in between in-store pick-up (which puts all the effort on the consumer) and direct delivery (which is hassle-free, but requires long periods of waiting and disruptions to daily life).

And, what’s more, many of the deciding factors from VODs also strongly influence users here:

- Convenience

- Exclusivity

- Adaptability

So let’s look at each a little more closely, primarily in terms of how it benefits customers and how it individual providers might adapt and evolve it for their own advantages.

Convenience

The popularity of parcel lockers has undoubtedly proven that shoppers are bothered less by a 5 or 10 minute trip to the locker than waiting all-day for a courier to “probably” arrive 😉. This is supported highly by the fact that parcel lockers are often placed in key strategic areas, such as shopping centers or gas stations, that people are likely to visit or walk past anyway.

This is one area that most likely won’t change in a more competitive market. In fact, if the following two factors don’t influence it, this has the potential to provide a net-win for both individuals and businesses alike. However, this alone is not a singular factor. As we’ve seen in the VOD battles, it’s not just about lower pricing.

Exclusivity

Arguably one of the biggest successes behind current parcel lockers is the majority hold that each vendor has had over their respective markets. Ordering in Poland? There’s a very high chance you’re sending to an InPost locker.

But remember that convenience is often tied to location. So what happens if one provider managed to secure exclusive deals with a nationwide chain? Exclusivity is a powerful tool. It’s why the likes of Disney and HBO were able to crack-open the VOD market – they had options that Netflix simply didn’t.

And what if one provider goes exclusive with a popular e-commerce store or business? This would lock out the other vendors in that business, removing the choice from the customer. And if exclusivity comes at a lower price – it may prove very tempting for such companies.

Adaptability

The most successful businesses are those that adapt to customer needs. With parcel lockers, there are numerous factors that contribute to their own ability to adapt to customer lifestyles:

- Wide range of locations – we’ve already covered this 😊

- A pick-up period that gives users the convenience to receive the parcel at their own pace

- Package sizes. Even individual providers offer support for larger and smaller packages, and we suspect there’s still room to expand in this area. Of course there’s an upper limit – bigger packages are not only more impractical to carry, they limit the amount of customers a locker can serve in a given amount of space.

- Multilanguage support. Currently, the Polish InPost service has both Polish and English support at the lockers, but the corresponding app is only in Polish. Surely there’s at least some market here for not only local non-natives, but also cross-channel business?

For each of these factors, it’s possible for each parcel locker to differentiate. InPost currently allows packages to be stored for 2 days. Who says that is the norm? Different providers can provide shorter (for a discount) or longer periods, finding their own niche partition within the market.

The Question of Brand Loyalty

Exclusivity aside, what happens when there are multiple options to choose from, each equally convenient? It’s not uncommon – especially here in Poland – to find such “locker meetings” where parcel lockers from different companies stand facing each other in close proximity.

In this case, the factor of brand awareness might be a make-or-break option for customers when faced with such a choice. After all, this is the reason McDonald’s and Burger King fight not only for primary locations, but also for premium advertising.

And when does brand loyalty not matter? Ask the post office… if you remember where it still is!

A Peaked Market

A recent report from Colliers showed that up to 97% of people already use parcel lockers in Poland. The market, at this point, cannot get much higher.

In other countries, such interest is already rapidly catching up. DHL is already a major rival in Germany, offering the 2nd largest “Out-of-Home” delivery network after Poland’s InPost. So even here, we can say that the markets will rapidly reach their maximum usage in the upcoming years.

This is why the above factors – convenience, exclusivity and adaptable offers – will become more critical. With a market at peak volume, competitors will likely turn to carving up the market in a bid for dominance.

What Does This Mean for Parcel Locker Providers?

When the market starts to peter out, the industry starts to look inward. When our parcel locker providers can no longer find new customers, it becomes a tug of war for the existing business. And while the public can use parcel lockers for their own use, we’re mostly focusing on the interactions of parcel lockers and businesses – as that makes up a key portion of their revenue and business models.

This inevitably leads to a battle for visibility and prominence. Which network has the most locations? Which network is more visible? InPost has made a name for itself, that’s certainly true, but DHL is a long-established brand in its own right.

What Does This Mean for Business?

For businesses, parcel lockers provide a reliable means to distribute their products without investing in their own logistics, in the same way that q-commerce supports the fast delivery sector.

Just like q-commerce, a wider range of options can be both a blessing and a curse. For the former, it brings advantageous pricing as providers compete to win businesses over. Regarding the latter, it may very well split the market, creating a situation where utilizing all options is the only viable option… thus removing some of the former’s benefits.

What Does This Mean for the Consumer?

For the individual on the street, it often means finding lockers in more and more … less convenient locations. In Poland, as the ‘leader’ of this industry, we’ve seen lockers behind buildings, in small alleyways and often facing a locker from another competitor.

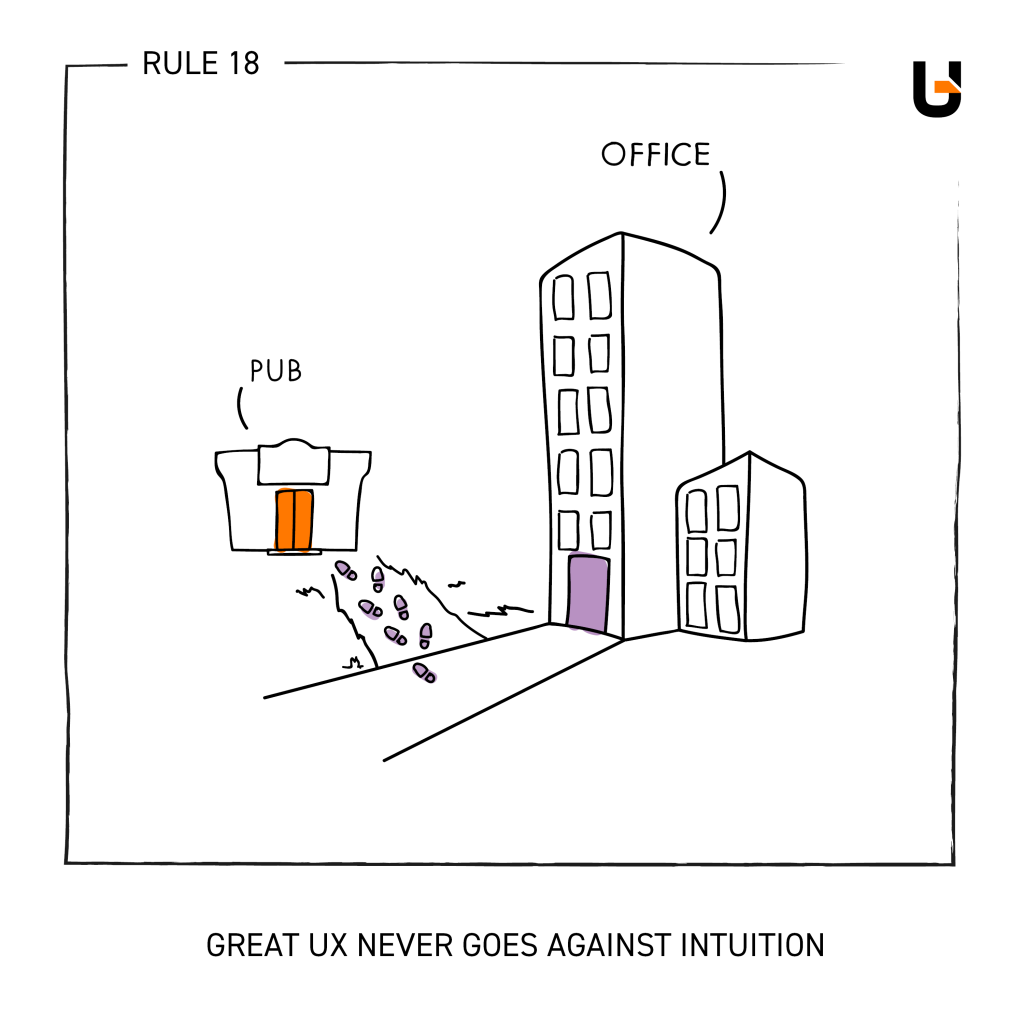

Joking aside, the consumer isn’t in the driving seat here – not unless businesses provide the choice. A customer at a checkout process can only use the provided means.

Was This Way More Than Anyone Needed To Say About Parcel Lockers?

… Perhaps 😊 But think about it; in their short amount of time on the market, these lockers have greatly disrupted a vital part of the retail process. They’ve enabled businesses and individuals alike, and we think that’s worth keeping an eye on, rather than simply taking it for granted.