Digital Debt / The Business Killer That’s Spreading

Some businesses were happy with being offline… until they were not. Recent events have pushed the issue of digital debt into the cold light of day.

The hard truth is simple: companies and other entities have suddenly found themselves in a reality where offline operations are no longer the backbone to rely on. This shift was significantly more shocking to organizations with giant digital debt, namely those maintaining the lowest possible levels of digital transformation.

For many, this has been an unpleasant introduction to an issue that’s always been present. We want to help soften the blow and guide you towards paying back this digital debt in the most painless way possible.

You can consider this an essential primer based on our years of experience in this field. Shameless plugs aside…

Digital Debt vs Technical Debt

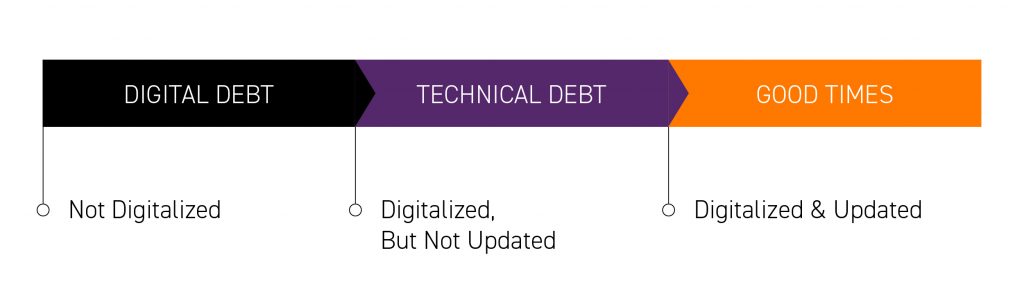

Technical Debt is an arguably more well-known issue, but it’s not the only one. To truly understand Digital Debt, it’s worth knowing the differences between the two.

What is Technical Debt?

Technical Debt is the accumulated costs associated with using outdated or otherwise ill-suited technology. It appears either as hidden costs resulting from the aging of a solution or as something designed into it from the very beginning – a limited lifespan or flaw, for instance.

The ‘debt’ itself can be summarized as the cost of reworking, measured in time, resources and costs, that would be required to update the solution using modern technology. Such debt occurs when companies embrace speed as an initial priority and later fail to shift with emerging trends, leading to solutions that rely on outdated and unsupported technologies – so-called Legacy Systems.

What is Digital Debt?

Digital Debt is the accumulated loss of profit or business momentum from not adopting digital channels or technologies. It can be measured as the difference in advancement a company has in regards to its peers on the market – in other words, how far it has fallen behind in necessary digital transformation efforts.

For example, a retail company that has yet to open an e-commerce channel has significant digital debt when compared to companies that have already opted for such a channel and are already improving on it. In this way, the debt continues to grow. A larger debt requires more resources and effort for a company to get a suitable position in the market where they are no longer held back.

The Difference?

Digital Debt differs from Technical Debt in that, while the latter is a result of a failure to innovate and stay up to date with current requirements, the former is a complete and utter failure to digitalize at all.

A company with Technical Debt has made the digital leap, but has failed to maintain momentum since then, thus losing any market position or advantages gained, while a company with Digital Debt isn’t able to compete in these channels at all.

Digital Debt in a Crisis

The world has changed. We don’t need to tell you that – but what we can highlight is the role digital debt has played around the world:

- Companies with an online model already up and running were at least able to mitigate some losses from regular trade – and had a foundation to build upon.

- Those that had nothing were hit with instant losses of revenue. To get started, they needed to invest.

- Furthermore, there were many organizations, such as schools, which had to adapt to entirely new approaches as they had never needed to consider digitalization at all.

When true misfortune struck the global economy, problems couldn’t be brushed off anymore with simple faith in the old ways of doing business. Likewise, neither waiting the situation out or relying on makeshift solutions have proven viable paths out of the predicament. Regardless of conditions, you should be asking yourself whether it’s wise to rely solely or primarily on traditional offline sales channels and manual business processes.

The numbers don’t lie, either. Adobe’s stock price in mid-February was worth around $380 and reached $460 in mid-November. Third quarter brought $3,23 billion of revenue to the company (14% year-on-year growth). What’s more, Grand View Research estimates that the global digital transformation was worth USD 284.38 billion in 2019, and it is supposed to grow at a stunning CAGR of 22.5% from 2020-2027.

In other words, those that made the digital leap have gained more than ever – often at the expense of those that didn’t. Digital Debt could have been noticed and dealt with had organizations been open to change.

Examples of Digital Debt (and How to Solve It)

It’s not all doom and gloom, however, as digital debt can very much be solved. Technology has advanced in numerous ways and, these days, most people have access to the internet. Solutions do exist.

We’re going to blow our own horn a little bit here – but it’s always better to talk from first-hand experience….

Cafes and Dining

Needless to say, the food industry as a whole was immediately hit, as the closing of bars, restaurants and cafes to the public was one of the first measures imposed in numerous countries. For many, this was the entirety of their operations.

Some migrated to third party delivery applications as a quick answer. Doing so meant a cut of the profits, but it meant the business could send products (in this case, food), to customers in the local area. However, this did shift companies to very competitive market places and offered little for loyal customers at all.

Green Gorilla in Switzerland, for example, resolved this by launching a dedicated app for their customers. The solution enabled users to pick-up their orders in a safe, contact-free approach, while also including all loyalty rewards and incentives not found on the larger marketplaces.

Retail and Shopping

The largest retailers out there already have significant e-commerce operations so, when everything changed, their customers simply moved from in-store to online purchasing. Companies like LPP have recorded big increases in online shopping this year as a result. They were open for business and their loyal customers had little problem adapting.

According to the US Census Bureau of the Department of Commerce, retail e-commerce sales increased by 31.8% between Q1 and Q2 in 2020. Similarly, in the second quarter has blessed Amazon with 40% sales growth and record-breaking revenue, while the pandemic has also put Walmart’s investments in e-commerce to great use – the company saw a 97% increase in online sales!

On the other hand, there have been a few companies that have outright refused to digitalize, even during this crisis. If you’re in the UK, you probably know we’re talking about Primark. The high-street retailer believed that online operations were against its business model and, during the strictest lockdown periods, it recorded months of zero percent profit and ultimately lost at least £800 million in 2020.

But what about smaller companies? Get online! E-commerce operations can be quickly set-up with the likes of Shopify or Magento. These ready-to-go platforms can easily handle most business needs and, together with integrations with delivery agencies, there’s an immediate solution to get the company up and running.

However, we do stress this is just the initial start. If we simply leave things as-is, we’ll shift from Digital Debt to Technical Debt.

Offices

There are whole swathes of sectors that rely on offices, such as most service-based industries. Before the pandemic, the office itself was seen as essential – how could companies operate without them?

Of course, we now know that an internet connection and a semi-decent workspace at home is all anyone needs to do their job. Thanks to the cloud, we can implement private solutions, such as web portals, to connect operations together. It’s really that simple.

HR, sales, management and more all thought that they couldn’t work remote. How times have changed.

Are You in Digital Debt?

We won’t go through all the specific characteristics of Digital Debt here, but we do want to help you quickly determine if you just might be in digital debt.

Ask yourself the following questions:

- Do you have a digital counterpart for the majority – if not all – of the products and services your business offers?

- Are your customers able to access your rivals via ways that they can’t access your business?

- Does closing your physical premises result in a complete loss of revenue, or do operations come to a halt?

If you answered “yes” to any of those, then we have some good news/bad news for you. Since everyone starts with the bad new first (because only monsters want to end on a negative note) – yes, you might just have Digital Debt.

The good news, if you haven’t already guessed, is that there is always a way out of the darkness. Technology is able to solve many problems and, as many have already realized for themselves, it’s easier and quicker to accomplish than you think!

We hope the information here has at least proved helpful but, if you need more (and more is always better) we invite you to get in touch!